Not known Facts About Offshore Company Formation

Table of ContentsGet This Report on Offshore Company FormationTop Guidelines Of Offshore Company FormationThe Ultimate Guide To Offshore Company FormationRumored Buzz on Offshore Company FormationSee This Report about Offshore Company FormationHow Offshore Company Formation can Save You Time, Stress, and Money.

Tax effectiveness is the main benefit, owners could additionally profit from lowered organization expenditures. There are frequently fewer lawful obligations of administrators of an offshore firm. You can also make a decision to have online office services that are both cost-effective and they additionally aid conserve time. It is likewise frequently easy to set up an overseas business as well as the process is simpler contrasted to having an onshore business in numerous components of the globe.Actually, there are other jurisdictions that do not call for capital when signing up the business. An offshore firm can work well for several groups of individuals. If you are an entrepreneur, for example, you can create an overseas firm for discretion purposes and for simplicity of administration. An overseas business can likewise be utilized to accomplish a consultancy business.

More About Offshore Company Formation

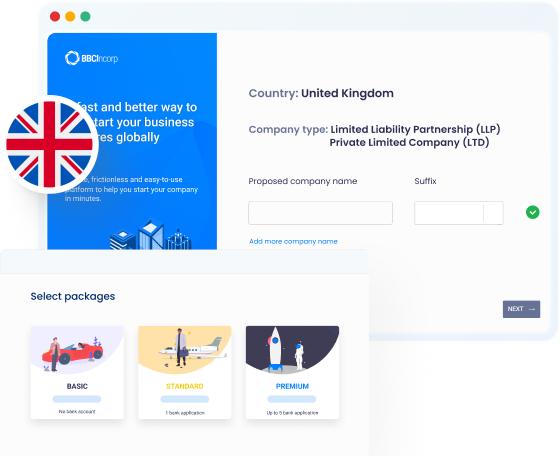

The procedure can take as little as 15 minutes. Also before forming an offshore firm, it is first important to recognize why you like offshore company development to setting up an onshore business.

If your major go for opening an offshore company is for privacy objectives, you can conceal your names making use of nominee solutions. With nominee solutions, another person occupies your role and also signs papers on your behalf. This indicates that your identification will stay private. There are a number of points that you should remember when picking an offshore jurisdiction.

8 Simple Techniques For Offshore Company Formation

There are fairly a number of offshore jurisdictions and the whole task of coming up with the best one can be quite made complex. There are a number of points that you additionally have to place right into factor to consider when picking an overseas territory.

If you established up an overseas business in Hong Kong, you can trade worldwide without paying any neighborhood tax obligations; the only problem is that you ought to not have an income source from Hong Kong. There are no taxes on capital gains and also financial investment income. The area is likewise politically and financially steady. offshore company formation.

With many territories to pick from, you can always locate the most effective location to establish your overseas business. It is, however, vital to take notice of details when developing your selection as not all firms will permit you to open for savings account as well as you require to ensure you exercise appropriate tax preparation for your regional as well as the international original site jurisdiction.

Offshore Company Formation - Questions

Company structuring and preparation have attained higher degrees of intricacy than ever while the need for anonymity continues to be solid. Corporations should keep up and also be continuously looking for brand-new means to profit. One way is to have a clear understanding of the attributes of overseas international firms, and how they try this may be propounded beneficial usage.

A more appropriate term to utilize would be tax mitigation or planning, because there are means of mitigating taxes without damaging the regulation, whereas tax evasion is usually categorized as a crime. Yes, because most countries urge worldwide trade and enterprise, so there are usually no constraints on homeowners working or having savings account in various other countries.

Rumored Buzz on Offshore Company Formation

Advanced and credible high-net-worth individuals and also companies routinely utilize offshore financial investment cars worldwide. Safeguarding properties in mix with a Count on, an overseas company can stay clear of high levels of earnings, resources as well as fatality taxes that would or else be payable if the assets were held straight. It can also shield assets from lenders and various other interested events.

If the company shares are held by a Trust fund, the ownership is lawfully vested in the trustee, hence acquiring the potential for also greater tax preparation advantages. Family and also Protective Depends on (perhaps as an option to a Will) for build-up of financial investment income as well as long-term benefits for beneficiaries on a desirable tax obligation basis (without income, inheritance or capital gains tax obligations); The sale or probate of buildings in various countries can become complicated and also pricey.

Conduct service without business tax obligations. Tax sanctuaries, such as British Virgin Islands, permit the development of International Business that have no tax or reporting obligations.

Getting The Offshore Company Formation To Work

This permits the charges to build up in a low tax obligation jurisdiction. International Companies have the same civil liberties as a private person and can make investments, buy and also offer realty, profession profiles of supplies as well as bonds, as well as perform any type of legal company activities as long additional info as these are not done in the nation of registration.